Solutions

INSTITUTIONAL

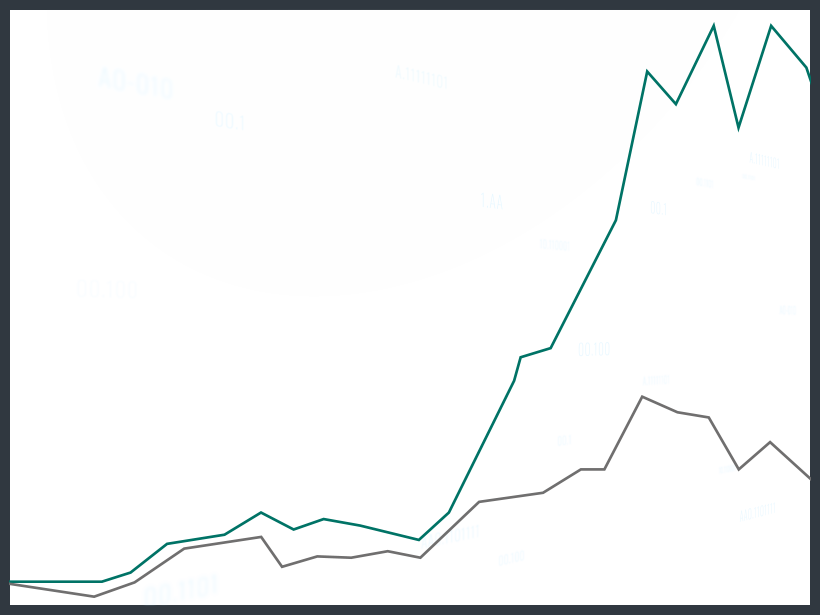

Achieve superior asset management results with AI

From the exploration of new investment opportunities to risk management and portfolio creation, rebalancing and optimization, AELIUM HELPS ASSET MANAGERS, HEDGE FUNDS AND FINANCIAL PROFESSIONALS

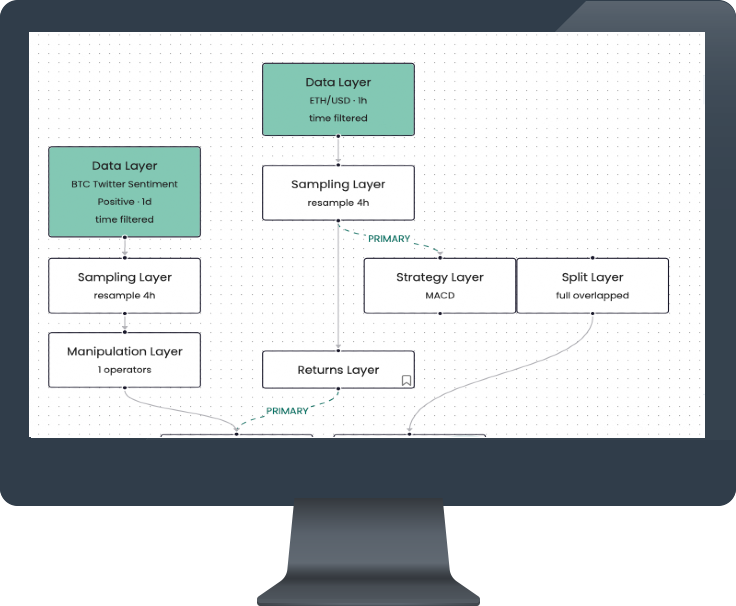

Managed AI Service

Managed AI Service

Integrate, into your existing workflow, customized AI models crafted to enhance complex strategies and portfolios, taking into account your specific constraints to optimize performance and assess risks related to cryptocurrency investments

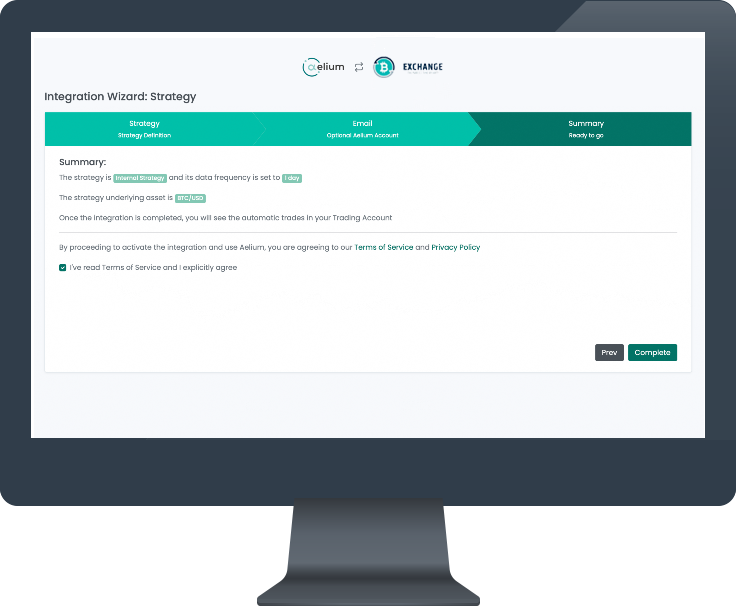

Exchange Platform Integration

Exchange Platform Integration

Seamlessly incorporate AI functionalities within your trading platform, offering your users real-time trading suggestions and enhancing their overall trading experience

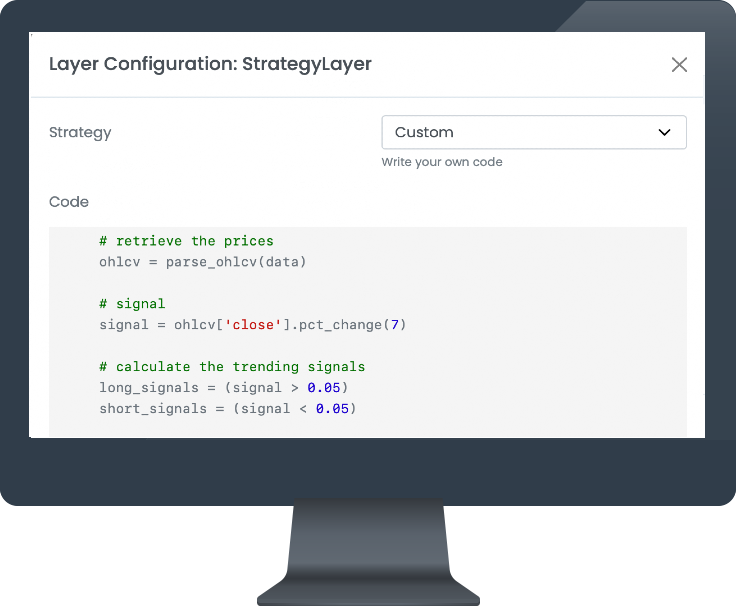

Strategy as a Service

Strategy as a Service

Aelium elevates your trading offerings with the power of AI. Tailored to your needs, our Strategy as a Service brings our quant and AI capabilities to your institution. We provide a professional service for building smart portfolios and trading strategies, including comprehensive insights, while enabling real-time adjustments